RIYADH: At the first Future Investment Initiative (FII) forum in Riyadh in 2017, one of the attending billionaire entrepreneurs urged Saudi Arabia, then just embarking on the Vision 2030 strategy of transformation, to follow the example of Nike and “just do it.”

On Tuesday, at the start of the fifth FII, the Kingdom, and the FII itself, have certainly gone for “it” in a big way.

Despite the challenges of the pandemic and other global issues, in the past five years there has been a big change in the Saudi economic scene, with the pace of the Vision transformation accelerating as social, cultural and economic measures take effect in the Kingdom.

The FII itself has also undergone a transformation, becoming a permanent institute and a fixture on the international forum scene, though still under the auspices of the Public Investment Fund (PIF), Saudi Arabia’s multi-billion-dollar sovereign wealth fund.

At the first FII, as billionaires, entrepreneurs and senior policymakers from around the world made their way to the Ritz-Carlton, Riyadh, and the adjoining King Abdulaziz Conference Center, some smart commentator with an eye for a catch-phrase came up with “Davos in the Desert” to describe the scene.

Despite the annoyance of the World Economic Forum, which organizes the extravaganza in the Swiss mountains, the phrase stuck, and FII has increasingly taken on the trappings of the annual Alpine gathering.

Among the nearly 4,000 attendees were such luminaries as then-IMF Managing Director Christine Lagarde, US Treasury Secretary Steven Mnuchin, and Larry Fink, chief executive of giant investment group BlackRock, who remains a regular at FII — all inquisitive to learn details of the Vision 2030 strategy Crown Prince Mohammed bin Salman had unveiled the previous year.

The crown prince set the tone for the event, and for subsequent years, with a keynote speech that unveiled the central message of what life would be like in the Saudi Arabia of the Vision 2030 era.

He promised a “return to moderate Islam that is open to all religions,” and to eradicate promoters of extremist thoughts, adding: “We are returning to what we were before — a country of moderate Islam that is open to all religions and to the world.”

The show-stealer of that first forum was Masayoshi Son, the chairman and CEO of Japan’s SoftBank. Earlier in the year, Son had unveiled the Vision Fund, the biggest start-up investment enterprise in the world, with a budget of $100 billion — including $45 billion from the PIF — to invest in cutting-edge technology that would transform the world.

Sharing a stage with Sophia the Android, the first robot to be “awarded” Saudi citizenship in a light-hearted ceremony, Son told the audience: “Every industry will be redefined. These computers, they will learn, they will read, they will see by themselves. That’s a scary future but anyway that’s coming,” he said.

The first FII was also notable for two other landmark announcements which have left an enduring mark on the Saudi economy and the global investment scene.

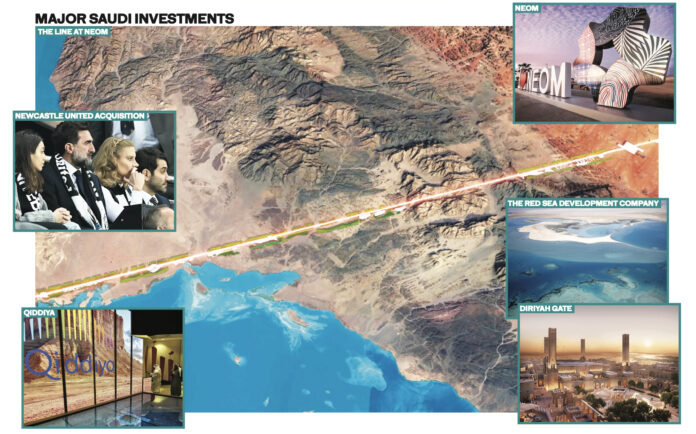

Crown Prince Mohammed bin Salman unveiled the master concept of NEOM, the $500 billion city-of-the-future to be built in the northwest of the Kingdom, which has since become the flagship project of the Vision 2030 strategy.

Carbon neutral and sustainable, the new metropolis would be served by an army of robots and driven by state-of-the-art digital technologies and artificial intelligence.

It would also create a new urban hub for innovation and enterprise in an under-populated part of Saudi Arabia. Other mega-projects followed, like the Red Sea development, the Qiddiya resort complex, the AlUla desert oasis with its historic cultural roots, and the Diriyah Gate development on the outskirts of Riyadh.

The second big announcement of that first FII was the unveiling of a financial road map for the PIF, aiming to make it the biggest sovereign wealth fund, with a target of $2 trillion assets under management by 2030.

The PIF was to be the main vehicle for the implementation of the Vision 2030 transformation, and also raise significantly the Kingdom’s profile in the international financial community.

The second FII forum, in October 2018, was overshadowed to some degree by the tragic murder of journalist Jamal Khashoggi in Istanbul earlier in the month, which led some top-level executives and media organizations to stay away, but for which regrets and condemnation were expressed by the crown prince from the stage at the opening keynote.

It was difficult for a visitor to see much difference. The attendance figures were as good as the inaugural launch; while some familiar faces were missing from the big set-piece plenary sessions, an army of more junior executives from many of the big banks, financial institutions and other global investors were happily doing deals at the event.

Some $60 billion in deals and Memorandums of Understanding (MoUs) were signed in 2018, across a range of sectors including energy, housing, health and technology.

The 2018 event attracted eight heads of state, 20 international ministers and was watched by 2.8 million viewers worldwide.

By 2019, when Yasir Al-Rumayyan, the PIF governor, declared the FII to be “one of the top three gatherings in the world,” it was business as usual, with an even bigger turnout of around 6,000 at the event and millions more tuning in worldwide from more than 110 countries.

Like most international events of last year, FII 2020 was impacted by the outbreak of the COVID-19 pandemic, which prevented it from being held in its customary October slot.

Instead, the fourth FII was held virtually in January this year, organized from Riyadh with the help of satellite hubs in New York, Paris, Beijing and Mumbai.

The theme was “The Neo Renaissance,” referring to the rebirth of global economic life after the shock of the pandemic the previous year. The event also developed what was to be an enduring theme, and a prominent element of the fifth event starting today in Riyadh: The importance of ESG — environmental, social and governance — standards in global finance.

In the five years since the first “Davos in the Desert,” much has changed. The FII itself is now a non-profit organization run by the PIF under Chief Executive Richard Attias, who is a prominent figure at the annual events.

Its one-item agenda consists of “Impact on humanity.” Meanwhile, the Saudi economy has developed and progressed with the FII.

It has emerged from the shock of the pandemic last year, and, in particular, Saudi Arabia has helped steer global energy markets through their most severe crisis for many years through its leadership, along with Russia, of the OPEC+ organization.

All the economic indicators in the Kingdom are heading in the right direction, with GDP this year forecast to show a strong recovery from the doldrums of the pandemic recession.

Higher oil prices will make a big contribution to stronger government revenues, which can also be used to finance the ongoing Vision 2030. Non-oil growth is also expected to rise sharply.

Despite the challenges of the past two years, the FII has become an integral part of the global investment scene and the international forums circuit.

The FII has “just done it,” and will do it again in Riyadh starting on Tuesday.