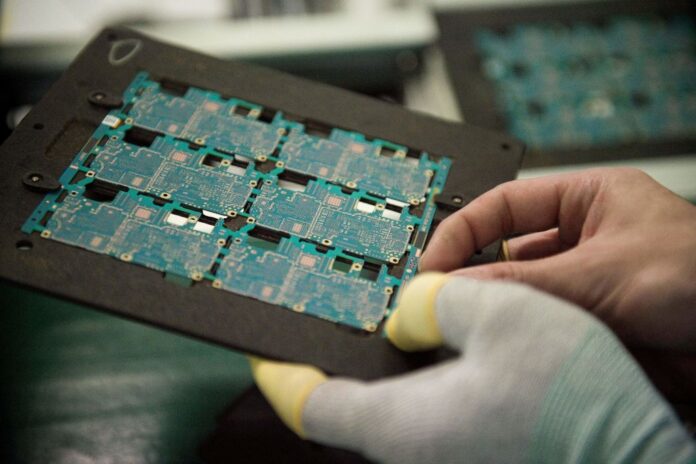

The EU on Tuesday unveiled a plan to quadruple the supply of semiconductors in Europe by 2030, hoping to limit the bloc’s dependence on Asia for a key component used in electric cars and smartphones.

The production of chips has become a strategic priority in Europe as well as the United States, after the shock of the pandemic choked off supply, bringing factories to a standstill and emptying stores of products.

The manufacturing of semiconductors overwhelmingly takes place in Taiwan, China and South Korea and the European Union’s 27 member states want factories and companies inside the bloc to take on a bigger role.

The highly anticipated EU Chips Act will “mobilize more than 43 billion euros ($49.1 billion) of public and private investments” and “enable the EU to reach its ambition to double its current market share to 20 percent in 2030,” the European Commission said.

“We’ve set ourselves the goal to have 20 percent of the global market share of chips production here in Europe,” European Commission President Ursula von der Leyen said.

Getting to that level “means basically quadrupling our efforts” given the huge increase in global demand, she said.

Thierry Breton, the EU’s industry commissioner, pressed Europeans to be as ambitious as possible and match similar plans in the United States, where the Biden administration is asking Congress to approve a $52 billion plan.

“Without chips, no digital transition, no green transition, no technological leadership. Securing the supply in the most advanced chips has become an economic and geopolitical priority,” he said.

If approved, the EU plans could generate a total of 43 billion euros via existing EU budget money as well as by loosening existing rules on public subsidy from member states.

Eleven billion euros of that will be fresh spending to develop state-of-the-art chips, while the remainder is an estimate of current EU projects and what member states individually are harnessing toward creating a new supply of semiconductors.

The proposal will need the approval of the EU member states and European Parliament, where opinions will vary between the ambitions of industrial heavyweights such as Germany, France and Italy and those of smaller states that are worried about closing off valuable supply chains with Asia.

Critics will also point to a part of the plan, pushed by Breton, to set up an emergency mechanism that could control exports of chips, in the case of a sudden shortage.

Some member states, led by the Netherlands and Nordic nations, will also resist any plan to widen the scope for state aid, with the commission planning to make it easier for EU governments to pump money to chip-makers.

“We don’t want to end up in a position with a huge US company getting a bunch of EU money to open a factory in one big member state,” an EU diplomat said.

But the pressure on Europe to move quickly is acute, with South Korea also promising huge sums of subsidies to ramp up its chip business.

These payouts will likely dwarf whatever Europe has on offer. In Taiwan, the chip juggernaut TSMC plans to spend between $40 billion and $44 billion just over the coming 12 months on new plants.

With nations eager to boost domestic supply, indications are that manufacturers are shopping around for the best deal as they seek locations for new factories.

Intel, the US-based chip-maker, is on the verge of announcing a major investment in Europe, with big players Germany, France and Italy possible destinations.

CEO Pat Gelsinger told German media his decision not only depended on questions of suitable locations and staffing “but also on the available subsidies to build the factories.”

“We have also obtained considerable subsidies for our factories in Asia,” Gelsinger said.

US car makers and medical suppliers warn chip shortage will last for more than six months