Riyadh: Sary, a business-to-business e-commerce marketplace, has raised SR281 million ($75 million) in a new funding round from a group of investors led by Sanabil Investments, wholly owned by the Public Investment Fund, as the platform seeks expansion in GCC.

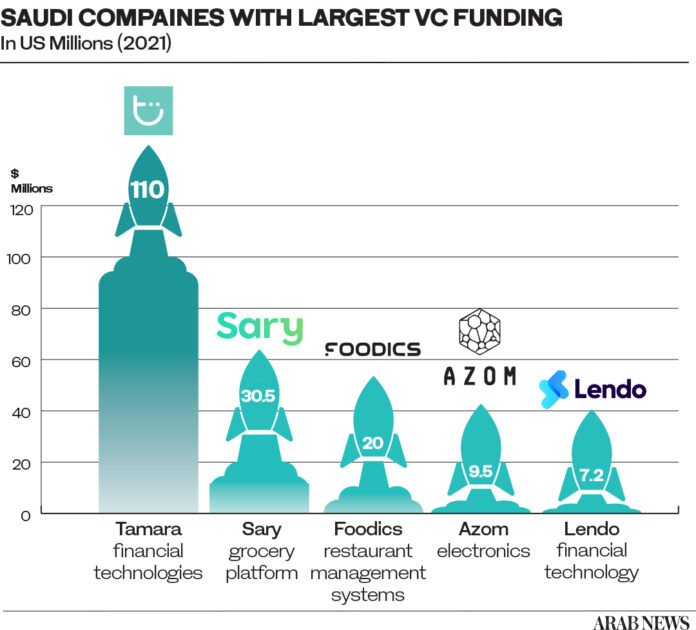

With the C round, Sary has managed to raise a total of $112 million in funding to date, making it one of the top funded Saudi startups this year by venture capital funds, according to a statement.

The Series C funding saw participation from new investors Wafra International Investment Company and Endeavor Catalyst alongside existing investors STV, MSA Capital, Rocketship.vc, VentureSouq, and Ra’ed Ventures.

With this new round of investment, Sary will grow geographically and will add new verticals and evolve its platformization model by expanding its offering to integrate native solutions and other third-party services, it said.

Sary funding status before today’s new C round

Sary attracted $37 million until May after a Series B round that was led by Silicon Valley’s Rocketship.vc, Saudi Arabia’s largest VC investor STV and returning investors Raed Ventures, MSA Capital and Derayah VC.

Sary was founded in 2018 by ex-Careem GM Mohammed Aldossary and his co-founder Khaled Alsiari. The company aims at transforming the procurement experience in the Middle East, North Africa, and Pakistan region starting with Saudi Arabia, leveraging technologies to connect micro and small businesses with wholesale players, empowering their businesses to grow smartly, it said in the statement.

Since its inception, the platform has reached more than 350,000 customers, serving over 40,000 businesses, and moving more than 270,000 pallets of goods across Saudi.

We congratulate Sanabil Investments, #aPIFcompany, for their investment in Sary @trysaryapp, a leading Saudi-based digital B2B marketplace connecting businesses to wholesalers. pic.twitter.com/ivyD82mNNo

— Public Investment Fund (@PIF_en) December 19, 2021