LONDON: Britain borrowed a record £215 billion ($285 billion) in the first seven months of the financial year, highlighting the challenge facing Finance Minister Rishi Sunak as he prepares new spending plans.

Borrowing in October alone came in below all economists’ forecasts in a Reuters poll at £22.3 billion, and September’s borrowing was also revised sharply lower. But debt remained only slightly lower than a 60-year high as a share of the economy.

Separate official data published on Friday showed retail sales rose 1.2 percent in October, and were 5.8 percent higher than a year earlier, stronger than all poll forecasts. However, retailers face a grim November with many shops closed due to the latest restrictions to slow the pandemic, which has hit Britain harder than other big economies.

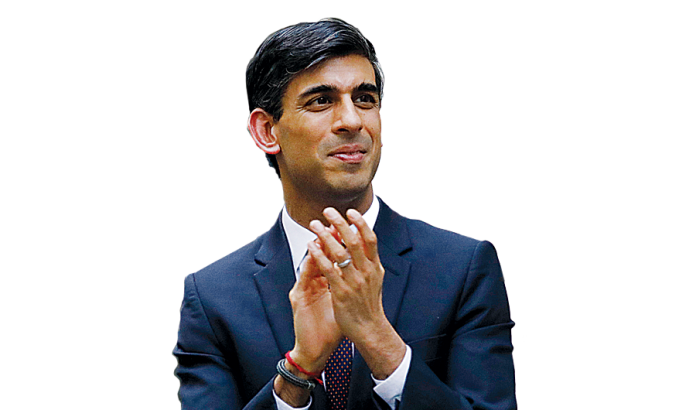

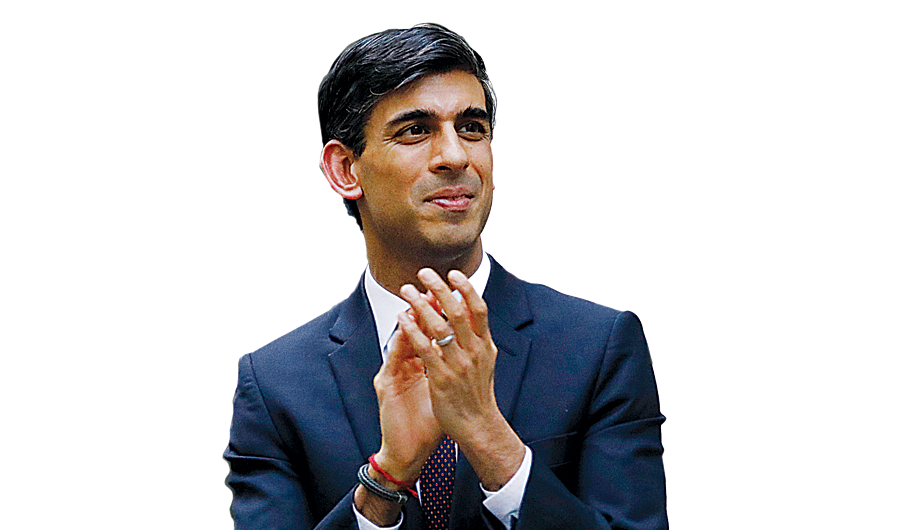

The British government is set to borrow close to £400 billion this financial year, the highest borrowing relative to the size of the economy since World War II. “This is the responsible thing to do, but it’s also clear that over time it’s right we ensure the public finances are put on a sustainable path,” Sunak said.

The government’s Office for Budget Responsibility will publish new forecasts of borrowing on Nov. 25, and Sunak will unveil spending plans for the next financial year too.

The government has already said that it will approve the biggest increase in military spending since the Cold War.

But newspapers reported that Sunak would freeze the pay of teachers and police, and the government has refused to confirm it will keep foreign aid spending at 0.7 percent of GDP.

Public debt has surged and stood at £2.077 trillion or 100.8 percent of annual economic output in October, the Office for National Statistics said.

Stronger growth in the economy in the third quarter meant that as a share of GDP, debt was down slightly from September’s peak of 101.2 percent, the highest level since 1960/61.

China’s new coal plants risk 2060 climate target, researchers sayCould China’s switch to electric vehicles speed end to era of oil?