A sudden uptick in food insecurity. A wave of evictions. People spending less money at shops and restaurants. More job losses.

According to leading economists, that’s what’s likely in store for the U.S. economy this year if Congress doesn’t renew any of the $600-per-week supplementary payment for unemployed workers by Sept. 1. Lawmakers have known for months that the payment was slated to expire at the end of July, but that deadline came and went. Now, Republicans and Democrats in Congress are still deadlocked over how much aid jobless workers should be receiving. Over the weekend, President Trump issued an executive order giving unemployed Americans a $400-per-week boost, but critics have questioned its legal and logistical viability.

According to the latest installment of our regular survey of quantitative macroeconomic economists,8 conducted in partnership with the Initiative on Global Markets at the University of Chicago Booth School of Business, the 32 economists in our survey collectively thought that not renewing the payment by Sept. 1 would make it 75 percent more likely9 that there would be a decline in personal consumption. They think plenty of other bad scenarios are more likely to occur, as well:

Economists fear an economic crisis without more aid

Average chance that each of the following scenarios will be more likely to occur if federal unemployment aid isn’t at least partially renewed by Sept. 1

| Scenario | avg. | chance |

|---|---|---|

| Decline in personal consumption | 74.8% | |

| Increasing food insecurity | 63.4 | |

| A wave of evictions | 55.2 | |

| More job losses | 53.5 | |

| More workers returning to the workforce | 43.2 | |

| A wave of mortgage defaults | 42.9 |

The economists also said we’re more likely to see job losses than workers returning to the workforce if Congress decides not to extend the unemployment supplement in any form.10 That might seem counterintuitive — how could a policy that seems likely to encourage more people to return to work actually result in more job losses? But recent research has indicated that the $600-per-week payment has been allowing jobless workers to continue to spend money as they would normally, at a moment when hiring still isn’t back to normal in many industries. And if losing the extra money causes millions of people to cut back their spending, businesses could suffer and lay off workers as a result. “The net effect on jobs is hard to say — on the one hand, lower spending implies some job losses, but that should be offset to some extent by more people returning to work and finding new jobs,” said Eric Swanson, a professor at the University of California, Irvine.

We also asked the economists about what might cause their worst-case predictions for fourth-quarter GDP to come to life. We gave them a bunch of different scenarios and asked them to weight which were most likely to bring about their nightmares. As a group, they said a lack of fiscal stimulus loomed almost as large as a bad second wave of COVID-19 infections. Notably, a lack of fiscal stimulus was a far greater concern than when we last asked the question in mid-June, although the level of worry about a second wave of coronavirus barely budged.

Possibility of no stimulus adds to economists’ fears

How much weight economists gave various scenarios when setting the lower bound of their GDP predictions for the fourth quarter of 2020

| factor | weight | |

|---|---|---|

| Bad “second wave” in the fall | 39.5% | |

| No further fiscal stimulus | 33.4 | |

| Low consumer spending | 14.8 | |

| Slow vaccine development | 9.4 | |

| Banking or financial system weakness | 7.8 | |

| Other | 4.4 |

“Clearly the survey participants see the federal UI supplement as being highly critical to the growth path of the economy for the remainder of 2020,” said Allan Timmermann, a professor of finance and economics at the University of California, San Diego, who has been consulting with FiveThirtyEight on the survey.

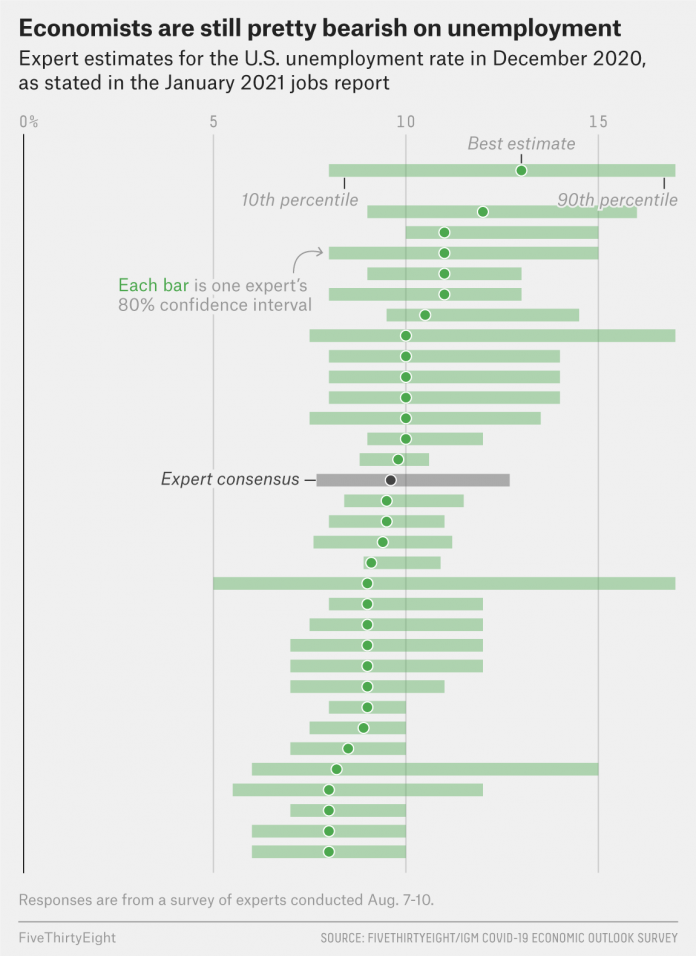

Overall, the survey indicated that even though the economists think it’s likely that the economy will continue to improve over the course of the year, they still don’t foresee a swift recovery for 2020. (The most recent monthly jobs report, released on Friday, suggested the same.) The economists’ consensus prediction was that the unemployment rate for August would be 10.1 percent, which would be essentially unchanged from July. They predicted a similarly minuscule drop for September, to just over 10 percent. And although the group anticipated that the unemployment rate will dip to 9.6 percent in December, the consensus forecast’s 10th percentile prediction was 7.8 percent and its 90th percentile prediction was 12.6 percent — emphasizing that there’s still a fair amount of uncertainty about what will happen over the course of the year, and how that will affect employment.

Remarkably, this bleak picture is more optimistic than the economists’ predictions in previous surveys. Back in May, for instance, the economists’ median estimate of December’s unemployment rate was 12 percent. “I think that economists have been surprised by the speed of bounce back of the labor market,” said Jonathan Wright, an economics professor at Johns Hopkins University. He has also been consulting with FiveThirtyEight on the survey.

But even their revised predictions are still pretty gloomy. “Remember that 10 percent used to be the depths of a severe recession, and other measures of the labor market like participation and underemployment are still very bad,” Wright added.

So while the July jobs report might have seemed, on the surface, to deliver good news, the survey makes clear that there is plenty that could keep us in the economic doldrums for the foreseeable future — particularly if Congress doesn’t act at some point soon. Menzie Chinn, an economist at the University of Madison-Wisconsin, said the July jobs report only confirmed his suspicion that the economic recovery was starting to plateau. Now, he thinks a W-shaped recovery — where the economy improves somewhat, only to crash again — is still possible, and “a stall is more and more likely.”

Julia Wolfe contributed research.