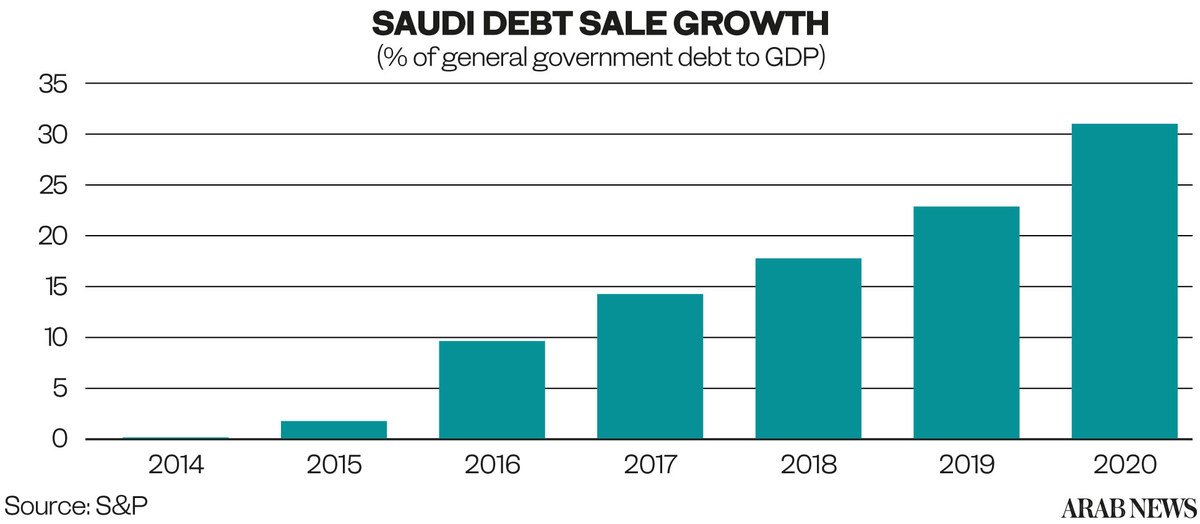

DUBAI: Saudi Arabia’s debt capital market is expected to grow as the Kingdom doubles down on its Vision 2030 goals, S&P Global said.

The Kingdom is banking on the increasing role of its debt and equities market in financing Vision 2030, the report said, as it seeks to attract more foreign direct investments.

“We think banks will continue to play an important role in financing Vision 2030, but foresee an increased role for the local capital market,” said S&P Global Ratings credit analyst Timucin Engin in the report published Tuesday.

The private sector will also contribute significantly to Saudi Arabia’s funding of its ambitious plans, S&P said.

“We understand that an increased amount of the funding will be pushed off the central government and onto the balance sheets of government-related entities and broader private sector,” it added.

S&P also projects a gradual rise in the use of Saudi Arabian riyal-denominated issuance as the local market develops. The US dollar is currently the currency of choice for such bonds.

Saudi Arabia has recently increased the volume of riyal-denominated sukuk from key government-related entities.

Greater issuance could attract more foreign investors, S&P said, especially as they search for higher-yielding investments in a market environment with low interest rates.

The banking sector alone will be “unable to fill the need” of Saudi Arabia’s planned investments under the 2030 agenda, S&P said.

Saudi Aramco first quarter profit surges 30% to $21.7bn